Compared to capsizing a small boat, getting lost on a large one is more worrying.

According to industry insiders, Celine, a luxury brand under LVMH, will see a global price increase of up to 20% starting from June 23rd. If this news is true, it will be Celine’s second price increase this year. In the fourth quarter of last year, the brand also underwent a quite aggressive price adjustment, with three price increases and significant increases a year, which fully demonstrated Celine’s intention to enter the ranks of top luxury brands such as Chanel and Louis Vuitton.

Since the leadership of celebrity creative director Hedi Slimane, Celine has refused all interviews and never explained herself. However, from a series of measures, enhancing brand positioning is the most significant brand strategy in the past year.

This strategy can be traced back to April last year when Celine announced the launch of the Haute Maroquinerie handbag series, customized from Nile crocodile skin. Each handbag is hand sewn by craftsmen and takes approximately 12 to 17 hours to make. Pricing needs to be negotiated privately. This move in the market means that Celine is officially moving towards the luxury handbag field in the higher price range, and the brand’s emphasis on rare leather particularly highlights the brand’s desire for Herm è s customers.

Last November, Celine released a new handbag Conti, priced as high as 55000 yuan on its official website, further approaching the price of Chanel’s classic flip handbag. Its similar appearance to Herm è s platinum bags and Kelly handbags has also attracted widespread attention from consumers.

According to the official introduction of the brand, Celine CONTA is made by top handmade leather craftsmen in the most traditional way, using saddle stitch method for manual sewing, and also comes with a bell shaped leather pendant with a gold lock. Handmade saddle stitching has long been a self proclaimed craft by Herm è s, and the bell shaped leather pendant with a gold lock is also a standard feature of Herm è s platinum bags.

In terms of fashion collections, Celine has quietly launched high-end customized products. In November, Celine also released a Celine Grand Soir series featuring Hedi Slimane personally holding the camera and supermodel Akon. This series consists of meticulously crafted items, including a 950 hour strapless short skirt made of 72000 black crystals and 21600 beaded pieces. Another embroidered jacket claimed to have cost 1200 working hours, using 267500 sequins and 132800 artificial diamonds.

The brand has labeled # CELINECOUTURE as a topic on its official Instagram account, and before that, Celine had no history of launching high-end uniforms.

The opportunity for Celine to suddenly turn to high-end is puzzling at first, because 2022 is undoubtedly the biggest harvest year for Celine after the implementation of innovative youth.

Hedi Slimane, under pressure, turned the ship’s bow and launched the milestone 2021 Spring/Summer series in 2020, following unsatisfactory business performance at the helm of Celine in the first two years. Since the beginning of this series, Hedi Slimane has gone from being loyal to the Parisian petty bourgeoisie style of the 1970s to reaching out to the global Tiktok new generation, launching a series of popular handbags and accessories loved by young people.

At the same time, thanks to LISA, a member of the idol group Blackpink who serves as Celine’s global spokesperson, and the celebrity effect of the new generation model Kaia Gerber, Celine experienced a counter trend outbreak in the last two years of the pandemic.

The sudden change in creative style immediately boosts performance. Last year, market analysts predicted that Celine had already surpassed the annual revenue threshold of 2 billion euros. This means that Hedi Slimane, who became the Creative Director in 2018, has completed the mission entrusted to him by LVMH, which is to double the brand’s performance within five years.

With the increase of brand scale, continuing to elevate positioning and moving towards luxury goods is in line with the increasingly polarized development trend of the current market. However, the problem is that the market has never always grown linearly according to a predictable trajectory, but is full of ups and downs.

People believe that Celine is now stubbornly implementing positioning improvements, which clearly lacks a solid foundation. Celine’s current situation has once again raised concerns, as the celebrity effect has reached its peak and the brand has begun to implement high-end products in the past year.

An undeniable issue is that consumers are beginning to experience aesthetic fatigue towards Celine. In China’s iconic luxury goods shopping malls, many netizens have expressed that the number of consumers queuing up to buy Celine has decreased compared to peak periods.

In addition, Celine’s pace of launching popular items has slowed down compared to the past two years. After the Triomphe Triomphe, the Presbyopia bucket bag, and the mini underarm bag, Celine’s new handbag has not caused much discussion in the market. The latest woven handbag launched by the brand mainly follows the fashion trends led by other brands such as Loewe, Prada, Miu Miu, and lacks the brand’s original advantage in key handbag businesses.

At the same time, Celine’s high-end handbag products have not yet gained the favor of the affluent Chinese population, and both 16 and CONT have not been widely sought after in the market. In the past year, Loro Piana’s Extra Pocket has become the new handbag that has truly divided the market share in this field, while Celine’s biggest competitor, Saint Laurent’s Manhattan handbag, has also benefited from the title of Herm è s Kelly handbag replacement.

In the ready to wear section, Celine once turned the jacket into a popular young Chanel tweed jacket style and led the way in the style of mixing formal and casual items. The intelligence of this move lies in the fact that Celine is not only selling the same poster item, but also a complete set of matching designs.

This not only increases the correlation rate of brand customers when making purchases, but also promotes the influence of a style to the mass market, giving ordinary consumers the motivation to imitate Celine’s styling style, thereby driving Celine’s market awareness. This is the foundation for Celine to further enter the top luxury goods camp.

Hedi Slimane’s effortless creative reversal reflects his effortless ability to shape his image. But the problem is that the younger generation never seemed to be Hedi Slimane’s personal passion.

To some extent, the post pandemic rejuvenation of Celine is a move adopted by Hedi Slimane to meet sales targets. As the window of the post pandemic trend of rejuvenation gradually closes, the affluent population with less impact on wealth has become a target for luxury brands to win over. Returning to classic style has become a common goal recognized by both Hedi Slimane and Celine management.

The 2023 autumn/winter women’s clothing collection, which was released early last December, became another turning point for Celine.

As early as November, Celine announced on social media that the 2023 Autumn/Winter collection would be held in Los Angeles, USA in December. This announcement is only three weeks after the recent release of the 2023 Spring/Summer women’s clothing collection in Saint Tropez, France, marking the shortest release interval in Celine’s history and indicating that a change is imminent.

In the end, this fashion show with the theme of “CELINE AT THE WILTERN” brought back even more luxurious dresses, as well as Hedi Slimane’s beloved hippie and rock style of the 1970s, in a grand manner. The veteran rock bands Iggy Pop and The Strokes performed live. People received a clear and accurate message that Hedi Slimane, who remained consistent regardless of how the times changed, had returned.

This is indeed a good thing for the loyal fans of Hedi Slimane, who have been complaining for several years that Saint Laurent’s products cannot meet their needs. Hedi Slimane’s more skilled men’s clothing collection also confirms this trend, reversing the loose silhouettes of the past two years and introducing ultra-thin jeans and other extremely small fashion styles, pulling people back to the fashion world 20 years ago. The anecdote of Karl Lagerfeld losing weight while wearing Hedi Slimane men’s clothing was not yet seen as a common case of body anxiety in the fashion industry at the time, but as a self demanding and motivational behavior.

However, for young consumers who have recently become Celine customers, Celine has become unfamiliar again. The brand’s Instagram interface is once again filled with Hedi Slimane’s beloved black and white photography, with most of the advertising scenery and store display images taken by him personally.

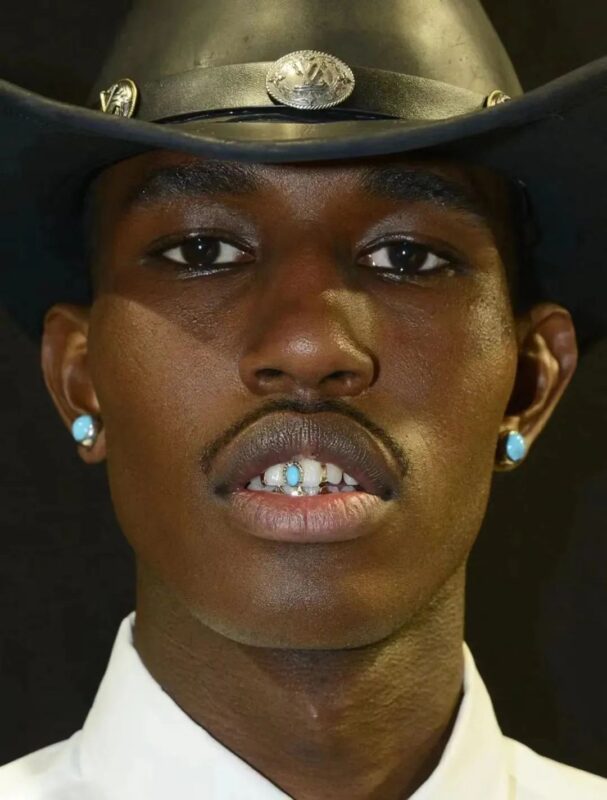

The casting of the model reflects Hedi Slimane’s personal style and highlights his rock temperament. His portraits of musicians also form a series, including rock singer Bob Dylan, Nick Cave’s son, and The Strokes lead singer Julian Casablancas. In the 2023 spring/summer women’s clothing series commercial, the skinny model is depicted with disheveled blonde hair and a strong retro black eye makeup, paired with tight pants, a plaid suit, and wide cut boots, reminiscent of the supermodel Kate Moss who was originally popular in street photography alongside Peter Doherty, the lead singer of The Libertines.

Faced with a Hedi Slimane returning to the rock era, young consumers represented by the Chinese market are clearly once again estranged from the brand. For the past two years, Celine has relied almost solely on fashion show short films, advertising videos, and idol celebrities to communicate with consumers, and has rarely conducted marketing activities. Even in 2021 and 2022, when the brand was most popular, Celine only held private ordering events for important VIC customers in the important Chinese market, without setting up marketing activities for brand culture construction.

This unique and mysterious brand style stems from Hedi Slimane’s strong control over Celine, as well as his insistence on traditional fashion operations in the early 21st century and pre social media era. It is conducive to creating brand uniqueness and scarcity when the brand has sufficient upward momentum, but it faces the danger of marginalization during the period of market fatigue towards brand aesthetics. In the war for attention, no one can stand alone because attention is money.

Moreover, the fashion image depicted by Hedi Slimane can only be empathetic to people from specific periods and regions. Younger luxury consumers from emerging markets around the world may be interested in entering Hedi Slimane’s style world, but in limited communication scenarios, they are also unable to establish dialogue. Through Lisa and Kaia Gerber, young consumers initially believed that they had brought Celine closer, but later felt alienated.

What is even more concerning is that the conflict between Hedi Slimane’s strong personal preferences and Celine’s decisions made for business reasons has become increasingly apparent in the past year. Throughout Celine’s most important vocal platform, official social media accounts, the release times of various series of the brand are chaotic. In order to maintain extreme simplicity and avoid unnecessary statements, the copywriting only lists key information such as time, location, characters, and series names. The interweaving of youthful Celine and Hedi Slimane’s personalized black and white aesthetics has forced people to develop cognitive dissonance towards Celine from the past year.

It can be said that during the two years before Hedi Slimane took office, Celine’s management boldly let go of the free play period, and the subsequent two years of youthfulness, although the contrast was huge, Celine maintained the same image during the two stages. But in the past year, various different voices have been transmitted from Celine, causing the brand to fall into communication chaos.

In the broader market discussion space, Celine CEO S é verine Merle, who took office in 2017, also remained silent and hardly disclosed any views or prospects related to brand development to commercial media. She stands in stark contrast to Francesca Bellettini, the helm of Saint Laurent, who is also a female CEO.

Unlike Saint Laurent’s obvious CEO leadership model, Celine seems to have more control over creative director Hedi Slimane rather than CEO S é verine Merle. This has also led to the fact that nowadays, although Celine and Saint Laurent brands are gradually no longer competing in style. However, in terms of deep level brand operation strategies, the market can see two completely different logics in these two brands.

In the article “YSL’s 5 Billion Euro Ambition”, the author provides a detailed interpretation of Saint Laurent’s establishment of a comprehensive and solid brand operation system led by Francesca Bellettini after the departure of former creative director Hedi Slimane. The polishing of the brand’s retail network and product operation, although not an explicit creative innovation, has solidified the foundation for the brand to climb towards higher positioning.

Building on the brand concept left by Hedi Slimane, Francesca Bellettini’s commercial operations and Anthony Vaccarello’s precise creative execution have driven Saint Laurent to achieve a milestone of 2.5 billion euros in 2021. Kaiyun Group stated that the brand’s next goal is to continue doubling sales and achieve a mid-term revenue target of 5 billion euros by 2026.

The brand founding gene that Hedi Slimane removed from Saint Laurent is now being retrieved by Anthony Vaccarello. He also started as an obedient creative director, gradually establishing a foothold and promoting Saint Laurent to expand the brand’s influence among young people through highly experiential fashion shows and celebrity ambassador Ros é and other marketing methods. However, the golden partnership he formed with Francesca Bellettini is still dominated by the latter.

The difference between Celine and Saint Laurent is that the former is result oriented and does not ask about methods, while the latter follows logic and follows a step-by-step approach. One is the rational leadership of the CEO, and the other is the emotional leadership of the celebrity creative director. Although Hedi Slimane has delivered the result of doubling its performance in five years, Celine seems to be lost and lacks strategy in the next five years.

Celine does not have as rich a history as Saint Laurent, nor do it have as many recognizable brand logos. Although Hedi Slimane has established a unique personal aesthetic, his personal aesthetic system is known for its captivating stability and singularity, just like his beloved black and white photography, which focuses on the rich layers within limitations but is not suitable for contemporary commerce where symbols are infinitely replicated.

He cannot create a comprehensive aesthetic universe for Gucci like Alessandro Michele, which can be freely accessed by brands.

Merely communicating with the market through limited proprietary channels is far from enough for Celine, which is facing fierce competition, and it is even more difficult to support its grand high-end ambitions. Although transformation pains are inevitable for every brand, Celine is currently lacking a comprehensive strategy.

A business strategy that focuses on improving positioning without emphasizing key elements such as retail performance and customer distribution, a creative style that returns to the personalized style of the creative director without emphasizing brand positioning, and limited and inefficient marketing do not constitute a brand system that is sufficient to continue to improve.

Fashion trends are a gust of wind, and the voice of marketing is fleeting. However, the reality is that luxury brands need to invest heavily to connect information fragments in order to have the opportunity to make a coherent voice in the era of social media and make brands deeply rooted in people’s hearts. According to industry conventions, luxury brands often invest around 12% of their revenue into marketing. LVMH owner Bernard Arnault once bluntly stated, “If we don’t do marketing, we won’t be able to establish ourselves in the luxury goods market.”

Interestingly, as a brand, Celine may lack a systematic approach, but if viewed as a person, Celine’s personality becomes increasingly prominent.

Due to Anna Wintour, Chief Content Officer of Continex, replacing Emmanuelle Alt, a friend of Hedi Slimane and editor in chief of the French version of Vogue, with a young talent, there are reports that Celine has voluntarily cut off cooperation with Vogue, and the two sides have yet to rebuild contact.

Vogue Runway has stopped reporting on Celine fashion shows since last year, and Hedi Slimane’s Celine, as a valued colleague of Karl Lagerfeld during her lifetime, surprisingly did not attend Vogue’s collaboration with the Metropolitan Museum of Art in New York to host the Karl Lagerfeld themed Met Gala, which also shocked the industry.

Recently, there have been reports in the industry that French fashion brands Ala ï a and Celine, under the Richemont Group, have collided with Paris Fashion Week schedules. Both sides plan to hold an outdoor fashion show in Paris on July 2nd, with a time gap of only 30 minutes, which means fashion editors and other industry insiders can only choose one of them to participate. According to the requirements of the Paris Fashion Federation, different brand fashion shows need to be separated by at least one hour during the official fashion week to allow participants enough time to participate in all activities.

Celine is stubborn and rebellious, jealous of evil as hatred. In many strategies of aggressive price increases and refusal to explain, Celine continues its brand personality of sticking to itself, with the aim of binding the most loyal group of consumers. Its winning side is that among too many corporate luxury brands that advocate goodwill and correctness on the surface, a personalized and clearly defined luxury brand may be able to win the hearts of young people.

However, one should also be wary that a large ship worth 2 billion euros is more difficult to turn around than three years ago.