At the moment when the scarf fell to the ground on the streets of Beijing at minus 10 degrees Celsius, the 95s girl Yu Hao even felt a little happy. My friend in the same industry finally saw the small logo wrapped up and half jokingly said to her, “Oh, your scarf costs over 6000, right?”. After hearing these words, Yu Hao felt secretly happy and said, “You finally saw my scarf.”

The scarf that made Yu Hao so concerned was LOEWE’s graffiti style. Since 2023, Yu Hao has been frequently “planting grass” as a brand product. First, he saw a bag on the back of strangers in the elevator, and recently, he was fascinated by a blue sweater on Yang Mi recommended by Tiktok.

Yu Hao has always been a loyal consumer of luxury goods, but when choosing luxury goods, she prefers brands with smaller logos that are not easily recognizable at a glance. “On the one hand, I want to be precise and low-key, and on the other hand, I don’t want to clash,” she said bluntly.

Yu Hao embodies the typical characteristics of Generation Z young consumers, urban white-collar workers, and many luxury goods consumers today: gradually abandoning big brands with big logos and high public awareness, and advocating for “de branding” and niche brands.

The subtle changes in consumer psychology, coupled with the slightly cooler global consumption environment in the post pandemic era, have brought about a huge change in the luxury goods industry, which has the attribute of “anti cyclical”.

From the perspective of the industry as a whole, although luxury goods have recovered from the epidemic in the past two years, they have shown another trend of decline since Q3 2023. Bain expects the global personal luxury goods market to perform weakly in 2024, with year-on-year growth rates expected to remain in the middle and low single digits.

As a global hub of luxury fashion, China’s luxury goods industry has basically converged with the global market. According to data from Yaoke Research Institute, the consumption of luxury goods in China increased by 9 percentage points year-on-year in 2023, returning to the level of 2019 and reaching 1042 billion yuan.

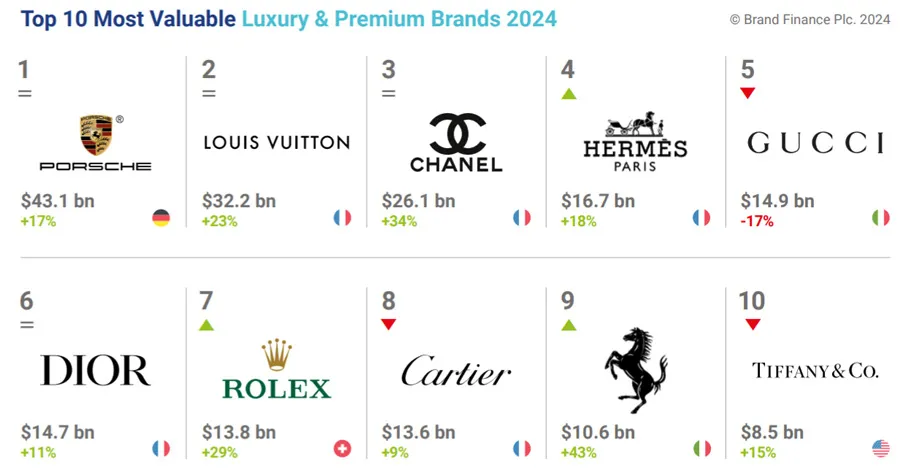

Although the overall scale is still growing, there are more brands that are difficult to sell, and the differentiation between major luxury goods is intensifying. A new round of reshuffle is quietly approaching. According to Bruno, Senior Global Partner at Bain, 65% -70% of luxury brands achieved positive growth in 2023, compared to 95% in 2022.

Under the turbulence, some brands that have been in the spotlight for many years have been overshadowed, while some relatively niche brands have taken advantage of the situation and stepped onto the stage, such as Roewe. In 2023, Roewe’s logo was selected by Lyst (a fashion website) as the most iconic brand logo of the year.