On March 20th, luxury goods industry giant Gucci’s parent company, Kaiyun Group, saw a sharp drop in stock prices shortly after the stock market opened, with the decline expanding to 15%, setting a record for the largest decline since 1992. “Gucci suddenly became unsold” has also become a hot topic on social media.

Moreover, this stock price downturn has also affected the entire luxury goods industry. After the opening on March 20th, Herm è s’ stock price fell by 2.5%, LVMH Group’s stock price fell by 3%, and Burberry’s stock price fell by 5.3%.

The sudden market shock has attracted widespread attention from the industry. According to analysis, this is mainly due to the sharp decline in sales performance of Gucci, an important pillar of Kaiyun Group, in the Asia Pacific region, which is expected to decline by nearly 20% year-on-year in the first quarter of 2024.

As an evergreen brand in the luxury goods industry, Gucci has been warmly sought after by young people in recent years. However, the current situation makes people wonder: why did Gucci suddenly lose its previous sales charm?

“The poor performance in reality and uncertainty in the future are the main reasons for the decline in stock prices.” Luxury expert Zhou Ting pointed out the reason for the “flash crash” of Kaiyun Group’s stock price in an interview with reporters.

On March 20th, Kaiyun Group issued a new warning on its performance for the first quarter of 2024. Kaiyun Group stated that based on current trends, it is estimated that the group’s revenue for the first quarter of 2024 will decrease by about 10% year-on-year. This performance mainly reflects the sharp decline in Gucci’s sales, especially in the Asia Pacific region. Kaiyun Group stated that Gucci’s sales in the first quarter of this year are expected to decrease by nearly 20% year-on-year.

As a leading luxury goods group globally, in addition to Gucci, Kaiyun Group also owns a series of well-known fashion, leather goods, and jewelry brands such as Saint Laurent, Bottega Veneta, Balenciaga, and Boucheron. However, in Zhou Ting’s view, Kaiyun Group’s reliance on a single brand is too high. “Chengye Guchi, defeated Guchi, other brands are not strong enough to influence the overall market of Kaiyun.”.

At the beginning of this month, Gucci just had a wave of price increases. The reporter consulted Gucci customer service as a consumer, and the staff said that Gucci has been on an upward trend and adjusts the prices of its products every year. This year, the price increased on March 1st. For example, the Gucci “Mamengbao” originally priced at 8700 yuan has now risen to 9800 yuan, with some increasing by over 12%.

Why did Gucci suddenly become unable to sell when the price of the product increased while the stock price plummeted?

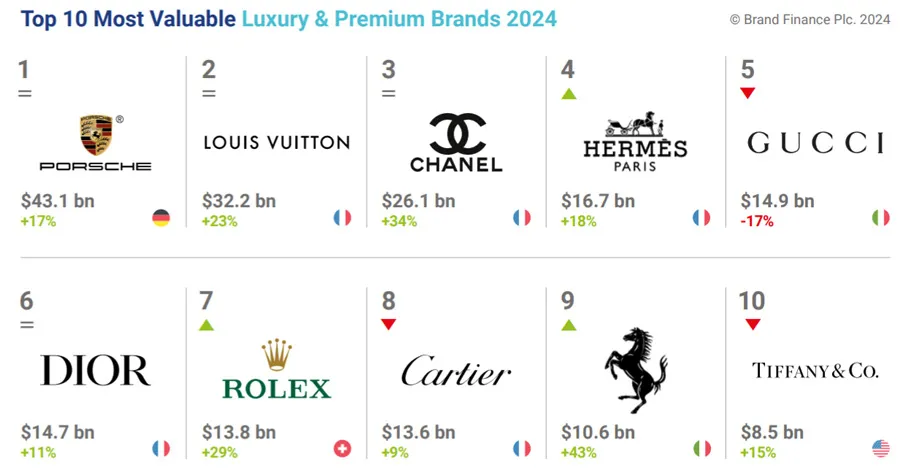

Regarding this, Zhou Ting pointed out that the collapse of brand image is the main reason. “Luxury brands are also further stratified, LV and Chanel are actively competing for Herm è s’ first luxury brand position, while Gucci is gradually withdrawing from the top tier luxury brand camp. The unsustainable product innovation is the second reason for Gucci’s sales decline. Diversified and personalized consumption, product innovation has become the core competitiveness of luxury brands, but it is obvious that Gucci has not made any achievements in product innovation in recent years.”.

At the same time, Zhou Ting believes that Gucci still has “a series of failed market strategies”. “In order to promote sales, Gucci lacks selectivity in customer base and sales channel selection, and its brand positioning is unclear, leading to a large number of customers fleeing and new customers unwilling to choose.”.

Looking back ten years ago, Gucci was still labeled as a “nouveau riche”, despite its highly recognizable logo elements, it could not escape the hidden concerns of brand aging.

In 2014, Gucci couldn’t bear it anymore and suddenly replaced the CEO and Creative Director. In 2015, he was succeeded by Chief Accessories Designer Alessandro Michele. Under the leadership of Michele, Gucci transformed his style and embarked on an “extremely complex” aesthetic, playing off-road on the path of “retro” and “romantic”. Representative items such as the God of Wine handbag, velvet shirt, horse buckle loafers, and dad shoes became popular items.

The wild and imaginative elements, vivid colors, bizarre style, and strong attitude of Gucci. When Gucci acquired the genes of “street fashion”, Generation Z, who held the economic power, expressed great satisfaction. Countless young people went crazy for Gucci, and Gucci successfully transformed into the Gucci of young people.

During AlessandroMichele’s tenure, Gucci achieved a “rocket speed” of sales growth exceeding 35% for seven consecutive quarters. From 2015 to 2019, Gucci’s sales increased from 3.8 billion euros to 9.6 billion euros, with a compound growth rate of 36%, just one step away from billions of euros.

However, the young customer base who supported Gucci’s popularity lacked loyalty and came due to personalized and diversified needs. When Gucci’s product innovation was unsustainable, they decisively chose to leave.

The decline in interest among young people, coupled with the impact of the global economy, has led to a significant slowdown in Gucci’s income growth since 2020. For the entire year of 2023, Gucci’s revenue was 9.873 billion euros, a year-on-year decrease of 6%. AlessandroMichele’s “extremely complex aesthetics” seem to be no longer playable.

In fact, it’s not just Gucci. On January 25, 2024 local time, LVMH, the world’s largest luxury goods company, released its 2023 annual report with a revenue of 86.2 billion euros, a year-on-year increase of 9%; The net profit reached 15.2 billion euros, an increase of 8%. Although this data roughly meets market expectations, LVMH’s revenue growth rate in 2023 has significantly slowed down compared to the company’s revenue growth rate of 23% in 2022.

According to continuous tracking data from Bain Consulting, after a significant contraction in 2020, the global personal luxury goods market experienced a V-shaped rebound in 2021, with a surge of 29%, and maintained a growth rate of 22% in 2022. But by 2023, based on current exchange rates, this growth rate will fall back to 4%.

Why is the growth curve of the luxury goods market tending to flatten out?

BarsaliBhattacharyya, Chief Analyst for Consumer Products at The Economist Intelligence Unit (EIU), said that during economic downturns, luxury brands often perform better than most other categories. This type of product caters to the needs of high-income consumers, who are less affected during economic difficulties.

“Luxury brands have elements that inspire consumers to yearn and pursue, which helps them maintain their pricing power. At the same time, wealthy consumers have more savings to spend on luxury goods, especially in situations where they are not free to travel or leisure activities. This is very helpful for luxury brands to increase sales in the first two years of high inflation. However, by 2023, the main consumer market is weak, leading to poor sales performance of luxury goods.”.

Julie Petit, partner and head of consumer goods, luxury goods, and retail at US consulting firm Mazars, said that despite the resilience of luxury consumption, many shoppers who crave luxury goods are feeling the weight of inflation. Johann Rupert, Chairman of Richemont Group in Switzerland, also warned last year that inflation and rising costs have even suppressed the demand of wealthy buyers in Europe.

In addition, analysts believe that the reason for the decline in performance of some luxury brands in 2023 is the relatively large proportion of young customers in their customer base. Compared to older and wealthier buyers, this group is more susceptible to economic pressure. It is reported that in the so-called “white-collar economic recession”, industries such as technology and finance have laid off employees, which has forced many high-income earners to reduce their frequency of purchasing luxury brands.

Starting from the beginning of last year, high-income customers began to reduce their luxury consumption. According to a luxury goods pulse survey conducted by luxury e-commerce platform Saks in May last year, respondents were concerned about the overall economy (60%), with only 53% of respondents stating that they will maintain luxury spending in the next three months, down from 62% in January 2023. However, in the latest survey released in January 2024, the results showed that although consumer luxury purchasing behavior is unlikely to undergo significant changes in the short term, luxury consumption may increase in the second half of 2024.